by Michael Snyder

The Economic Collapse Blog

According to the absurd numbers that the government feeds us, the unemployment rate is very low and there are lots of jobs available. But if what they are telling us is true, why are so many Americans not able to find work? As you will see below, some people haven’t been hired even though they have literally applied for hundreds of jobs. There seems to be an enormous disconnect between what is actually happening in the real economy and the economic narrative that they are constantly pushing. By the time you are done reading this article, I think that you will agree with me.

According to the absurd numbers that the government feeds us, the unemployment rate is very low and there are lots of jobs available. But if what they are telling us is true, why are so many Americans not able to find work? As you will see below, some people haven’t been hired even though they have literally applied for hundreds of jobs. There seems to be an enormous disconnect between what is actually happening in the real economy and the economic narrative that they are constantly pushing. By the time you are done reading this article, I think that you will agree with me.

Earlier this week, I received an email from a reader that has not been able to find work after seven months of searching.

He gave me permission to share part of that email with you, and it is certainly quite heartbreaking…

Does the Fed even matter that much to the real economy and investor portfolios?

Does the Fed even matter that much to the real economy and investor portfolios?

You would have thought that after the massive Covid debacles, where government misinformation and disinformation led to untold thousands of unnecessary deaths and gaps within childhood development and education, “they” would have been chastened. Maybe slinked off to hide from their fellow humans out of shame.

You would have thought that after the massive Covid debacles, where government misinformation and disinformation led to untold thousands of unnecessary deaths and gaps within childhood development and education, “they” would have been chastened. Maybe slinked off to hide from their fellow humans out of shame. Here’s why: New house prices -18% from peak, back to Nov 2021, further sweetened by mortgage-rate buydowns.

Here’s why: New house prices -18% from peak, back to Nov 2021, further sweetened by mortgage-rate buydowns. The Silver Institute released its 2024 World Silver Survey

The Silver Institute released its 2024 World Silver Survey

A gag order that severely limits what former President Donald Trump can say publicly about a case where a Democrat district attorney is seeking to put him in jail was the focus in court on Tuesday as part of the business records trial he faces in Manhattan.

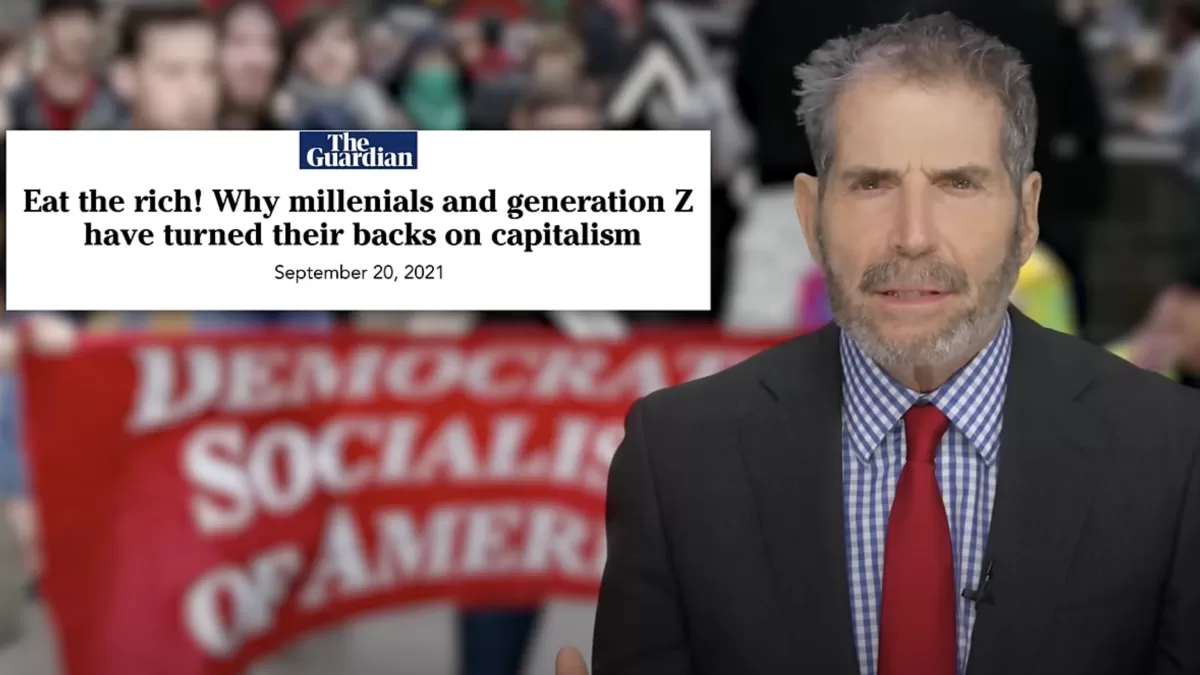

A gag order that severely limits what former President Donald Trump can say publicly about a case where a Democrat district attorney is seeking to put him in jail was the focus in court on Tuesday as part of the business records trial he faces in Manhattan. Capitalism and racism go together?

Capitalism and racism go together? Thought you’d seen the stupidest of the “green” movement? Think again, because here come “green” locomotives; here’s what Nick Pope at the Daily Caller News Foundation reported yesterday:

Thought you’d seen the stupidest of the “green” movement? Think again, because here come “green” locomotives; here’s what Nick Pope at the Daily Caller News Foundation reported yesterday: Over the past two years, whenever it has come up, I’ve sought to remind interviewers of the most significant financial action of 2022. After the political events of this past weekend, it’s time to discuss this again.

Over the past two years, whenever it has come up, I’ve sought to remind interviewers of the most significant financial action of 2022. After the political events of this past weekend, it’s time to discuss this again.