from Kerry Lutz's Financial Survival Network

Kerry Lutz was joined by CEO Ivan Bebek of Coppernico Metals for a dive deep into the company’s ambitious exploration project. From raising over $100 million to the strategic preparations for drilling, Ivan shares the challenges and milestones of Coppernico’s journey.

It’s been years in the making but the company has achieved the required community support and now has the necessary permits to begin aggressive drilling at the Sombrero project. As Ivan states, community support must be earned, and the company’s initiatives will carry on long after mining has finished.

There were numerous hurdles along the way, not the least of which were the pandemic related shutdowns. But Coppernico persevered and now drilling and a coveted TSX listing will be happening soon. Ivan also introduced Tim Kingsley, VP of Exploration, highlighting the team’s expertise along with the strong funding from major miners. Clearly this is a case of playing the long game, staying focused upon the ultimate goal and never giving up. Coppernico’s prospectivity is impressive and we hold shares in the company.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

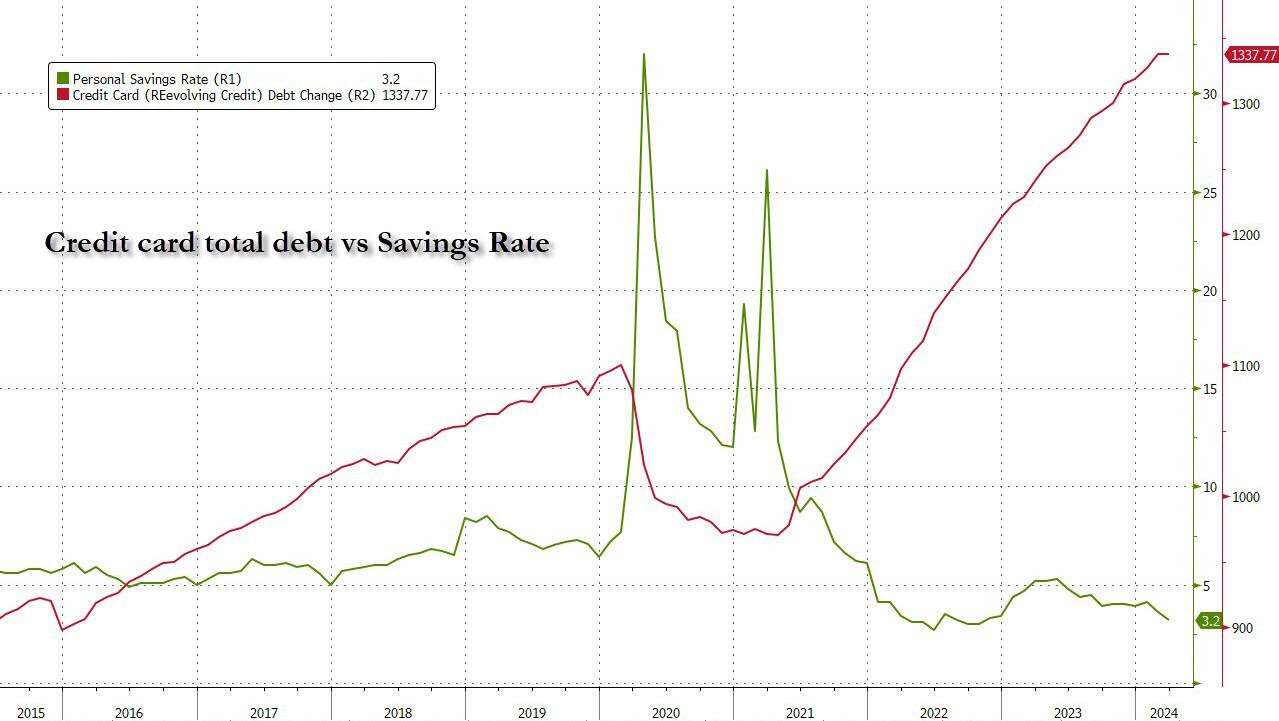

Decades of interest rate suppression have resulted in debt traps in both public and private sectors which will destroy faith in fiat currencies. This leads to higher, far higher interest rates and the escape into gold is only just starting.

Decades of interest rate suppression have resulted in debt traps in both public and private sectors which will destroy faith in fiat currencies. This leads to higher, far higher interest rates and the escape into gold is only just starting. This is how ‘trickle-truthing’ works. A little bit of a painful truth is leaked out over time. Each time a little more. The idea is that this causes less of an explosion than simply being truthful up front.

This is how ‘trickle-truthing’ works. A little bit of a painful truth is leaked out over time. Each time a little more. The idea is that this causes less of an explosion than simply being truthful up front. War is one of the few things that only the State can do. Indeed, as Randolph Bourne said, “War is the health of the State.” Let’s briefly discuss the nature of the State to see why World War 3 is on the way.

War is one of the few things that only the State can do. Indeed, as Randolph Bourne said, “War is the health of the State.” Let’s briefly discuss the nature of the State to see why World War 3 is on the way. We have a special place in our heart for DoubleVerify because it blacklists WOLF STREET in the “brand safety” services it touts to advertisers.

We have a special place in our heart for DoubleVerify because it blacklists WOLF STREET in the “brand safety” services it touts to advertisers. It’s another slow news day but, because of that, the weekly jobless claims data got far more attention than usual. And it’s a good thing, too, as the weekly totals finally budged off of the ridiculously stable 212,000 number for the first time in weeks.

It’s another slow news day but, because of that, the weekly jobless claims data got far more attention than usual. And it’s a good thing, too, as the weekly totals finally budged off of the ridiculously stable 212,000 number for the first time in weeks. On April 24, two lead developers of Samourai Wallet (SW), the most-advanced privacy-centric wallet in the bitcoin ecosystem, were arrested and charged with money laundering and money transmitters offenses by order of the United States Department of Justice (DOJ). This is just the latest assault of an escalating war waged by US regulators on financial privacy and freedom.

On April 24, two lead developers of Samourai Wallet (SW), the most-advanced privacy-centric wallet in the bitcoin ecosystem, were arrested and charged with money laundering and money transmitters offenses by order of the United States Department of Justice (DOJ). This is just the latest assault of an escalating war waged by US regulators on financial privacy and freedom.

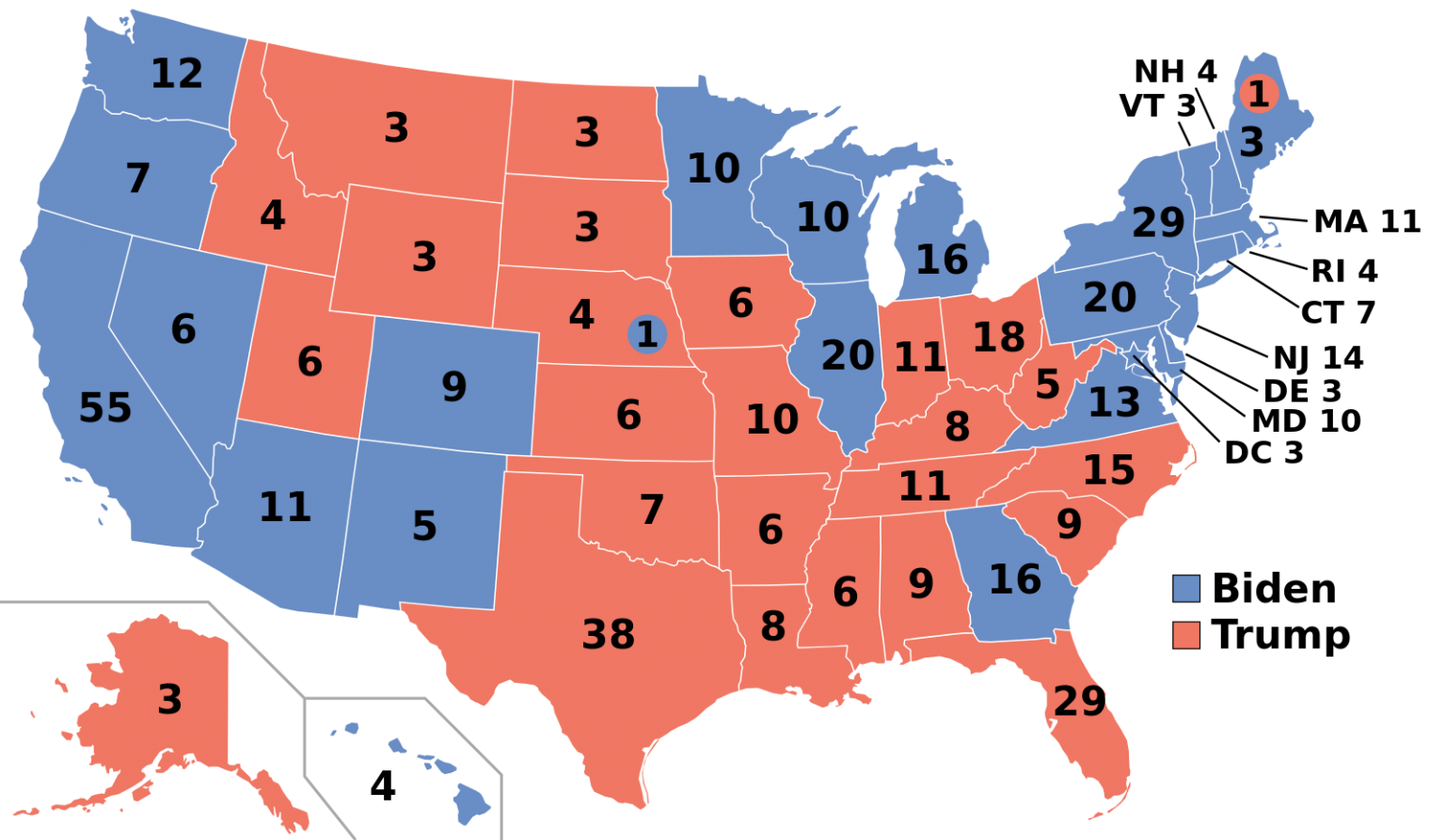

In recent years we have literally seen millions of Americans relocate from blue states to red states. In some cases, there is simply a desire to be around other like-minded people. In other cases, specific political policies that have been enacted in certain states have motivated large numbers of people to relocate. This was particularly true during the pandemic. Of course there are also many that are just trying to escape the crime, drugs, homelessness and violence that are plaguing so many major cities in blue states. For those that are trying to raise a family, finding a safe environment for their children is often of the utmost importance. As a result of the factors that I have just mentioned, we have been witnessing a “mass exodus” to “Red America” that is unlike anything we have ever seen before. Vast numbers of people have been moving from blue states such as California, New York and Illinois to red states such as Florida, Idaho and Montana…

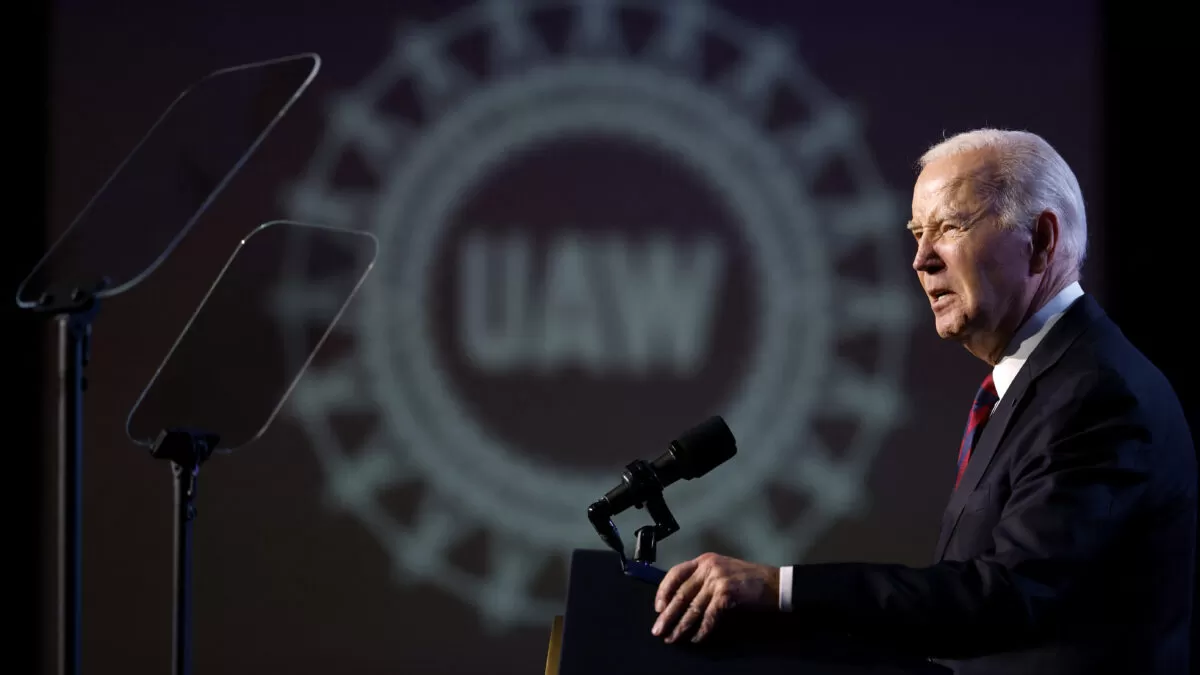

In recent years we have literally seen millions of Americans relocate from blue states to red states. In some cases, there is simply a desire to be around other like-minded people. In other cases, specific political policies that have been enacted in certain states have motivated large numbers of people to relocate. This was particularly true during the pandemic. Of course there are also many that are just trying to escape the crime, drugs, homelessness and violence that are plaguing so many major cities in blue states. For those that are trying to raise a family, finding a safe environment for their children is often of the utmost importance. As a result of the factors that I have just mentioned, we have been witnessing a “mass exodus” to “Red America” that is unlike anything we have ever seen before. Vast numbers of people have been moving from blue states such as California, New York and Illinois to red states such as Florida, Idaho and Montana… Unions are said to be having a moment. The story goes something like this: Helped by a presidential administration that touts itself as the “most pro-union in history,” labor unions—after decades of decline—are winning big victories against anti-union corporations and extracting impressive concessions for their workers. But is it all true?

Unions are said to be having a moment. The story goes something like this: Helped by a presidential administration that touts itself as the “most pro-union in history,” labor unions—after decades of decline—are winning big victories against anti-union corporations and extracting impressive concessions for their workers. But is it all true? Special Prosecutor Jack Smith has just admitted that he and other DOJ and FBI minions manipulated documentary evidence underlying the Mar-a-Lago case against Donald Trump. Everybody from Judge Aileen Cannon on down realizes this is bad. Still, I wonder how many people have noticed that Smith has admitted to doing what the J6 defendants are accused and have been convicted of doing: Violating 18 U.S.C. § 1512(c)(2). The statutory charges against the J6 defendants are a specious abuse of the law but they perfectly fit Smith’s admitted conduct.

Special Prosecutor Jack Smith has just admitted that he and other DOJ and FBI minions manipulated documentary evidence underlying the Mar-a-Lago case against Donald Trump. Everybody from Judge Aileen Cannon on down realizes this is bad. Still, I wonder how many people have noticed that Smith has admitted to doing what the J6 defendants are accused and have been convicted of doing: Violating 18 U.S.C. § 1512(c)(2). The statutory charges against the J6 defendants are a specious abuse of the law but they perfectly fit Smith’s admitted conduct. Yes, We were told lies about the safety and effectiveness of the Covid “vaccines.”

Yes, We were told lies about the safety and effectiveness of the Covid “vaccines.”